Table of Content

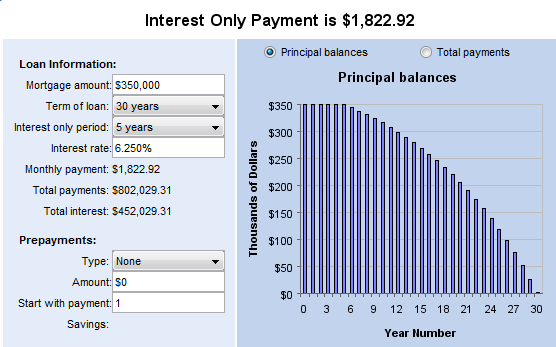

The 'cost' of the 5-year interest-only period was $75,000 ($15,000 X 5 years), which makes the interest-only mortgage about $30,000 more expensive overall. Interest-only - as you only pay the interest on the loan, at the end of the loan you will owe the same amount you originally borrowed. Our newsletter covers the latest market news including content from Tony Alexander, as well as tips for getting, managing and reviewing a mortgage. Let us introduce you to an expert mortgage adviser for advice that offers you the most benefits. We really do have a fragmented , uncoordinated approach to this housing crisis don't we? The RBNZ is doing one thing , the Government has , until recently been in denial , and the banks continue to do anything they want to grow their lending book .

However, the market slows, and your property loses value, then your mortgage reverts to principal and interest. Property prices in New Zealand tend to rise over time, but they can fall. If you have an interest-only mortgage and prices start to fall, you could end up with negative equity.

Advantages & Disadvantages of Interest Only Loans

With an interest-only mortgage, you don’t repay the money you’ve borrowed at first. Instead, you pay off the interest on top, which makes your repayments much smaller. However, eventually, you have to repay the mortgage in full, and your payments get larger.

Problems have been caused in places like the UK where customers have been required to repay loans at the end of their interest-only period and not been able to, and then not been able to refinance. Westpac NZ last week announced it was reducing its interest only lending term from 15 years to a maximum of five years "as investors continue to dominate the housing market". The RBNZ said in May 2016, almost 60% of all new mortgage lending was on principal-and-interest payment terms, while 40% was on interest-only payment terms. In December 2014 The Australian Prudential Regulation Authority warned lenders it was "dialling up the intensity" of its supervision to reinforce sound residential mortgage lending practices. And the Australian Securities and Investments Commission said then it would "conduct a surveillance" into the provision of interest-only loans. The best home loan strategy is one that takes into account your individual circumstances, like your cash flow.

Kiwibank 5 Year Fixed

Cash advances, a competitive interest rate and the bank's rubber stamp ready to approve. Can you imagine walking into a bank asking for an interest free loan to fund your speculative share investment portfolio? Good luck convincing the bank, plus even if you got your loan it would be at the bank's higher business interest rates.

While we are independent, we may receive compensation from our partners for featured placement of their products or services. Persistently high inflation could see back-to-back increases to the cash rate, according to a new Finder poll. Lenders are still careful when assessing interest-only borrowers.

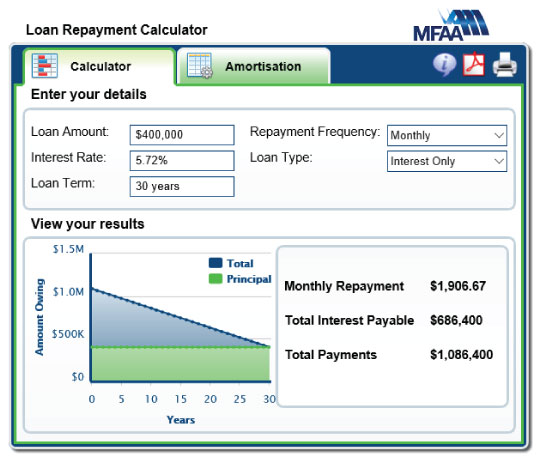

Interest Only Loan Calculator

Go to your bank and try asking for a IOL to purchase a dairy farm or any product based business? Reining in interest-only lending would be presumably one measure the RBNZ could consider to rein-in the fast rising house market. There's no suggestion at this point though that such a move is among the macro-prudential measures currently under urgent consideration. Another set of monthly interest-only figures are due out from the Reserve Bank before the end of this month. Doubtless the central bank will be watching closely for any marked upward blip in the figures.

If budgeted correctly, consumers should be able to afford to do so as they are paying less interest. This means when interest rates do rise again, you’ll be accruing interest on a smaller loan amount. Since interest-only loans are relatively specialised products that only appeal to some buyers, they aren’t offered by all financial institutions.

While it’s great for investors to have the extra cashflow, if it isn’t approved you are still paying down debt, which improves your financial position. Secondly, an interest-only mortgage is much more tax efficient, especially when an investor already has a personal mortgage. This is because an investor can use the money she or he would otherwise put into the investment property and use it to pay down his personal mortgage. When you apply for an interest-only mortgage you need to give a reason why you want this loan. For property investors this can usually be as simple as interest-only loans provide better savings for property investors when they still have a personal mortgage. When interest rates are at historic lows – as they are at the time of writing – it’s a good time to pay down your loan principal.

Let’s say you get to the end of your first 5-year interest-only period, and then apply for another. Using this strategy you could theoretically keep extending the interest-only period. The aim of the game is to pay down your debt on your owner-occupier. A bank has to have a reason for approving an application for an interest-only loan. This is the ultimate guide on how to get an interest-only mortgage in New Zealand. Property Investment Video Course 20 video lessons with hour long content on how to invest in property the right way.

Pay off your mortgage with a lump sum, which is usually only an option if you have liquidated another asset. Interest-only mortgages have a lot of advantages, but there are risks - we discuss these in detail below. Interest.co.nz is partnered with Calculate.co.nz for New Zealand's highest quality calculators and analysis. I for one will be out in the street partaking in violent civil disobedience if the banks are bailed out....

NBS Home Loan Rates1 Year Fixed6.89% p.a.2 Year Fixed7.39% p.a.Variable8.25% p.a.NBS Flexi Loan - Interest rates start from7.75% p.a.Interest rates are current for new facilities. For existing clients, these variable rates come into effect on 14th January 2023. Experience friendly, personal service like you never have before.

This includes loans where borrowers independently choose to repay principal such as revolving credit loans which have a fixed limit. The borrowing rules change from time to time, and different rules are in place for Auckland. Property investors will use interest-only mortgages at a lower rate quite favourably because typically house prices increase 7% annually . If you borrow at 5%, you’ll have a 2% buffer as a safe zone to protect the investment. If you know that your mortgage repayments will rise when the interest-only period ends, having some extra cash saved up could help you meet the higher repayments. If your loan has an offset account, putting extra savings there is a good idea.

For new build homes, see how we can help you go from blueprint to build. Take out a new ANZ Home Loan of $100,000 or more and you could get a cash contribution of 1%, up to a maximum of $20,000. New home loans must be approved and documented by 31 March 2023, and the cash contribution is conditional on keeping your home loan with ANZ for at least three years. Scott and Liz can walk away from the house and have it repossessed by the bank, but they will lose their $200,000 deposit and $50,000 bathroom improvements. Later, Auckland's house market slumps and the house is now worth $825,000.

This means you can split your home loan between both options, taking advantage of certainty and exposing you to the risk of interest rate changes. Many property investors finance their mortgages on an interest-only basis - Stuff.co.nz reported that in 2016, 40% of new mortgages were interest-only. Banks require a deposit, but the terms of an interest-only mortgage are attractive to landlords. Firstly, the repayments are a lot lower, so rental income can cover the monthly payments to the lender. Secondly, the IRD allows interest expenses to be tax deductedmeaning the cost of financing is much lower. Where property investors can get caught out is when the interest only terms expire after five years.

Assisting in managing your budget and giving you time before full principal and interest repayments need to be made. You can compare home loan interest rates below, making it easier to shop around for the best mortgage rates that suit you. If you’re looking for an interest-only deal, there are more risks involved. Check out our interest-only mortgage calculator and guide.

No comments:

Post a Comment