Table Of Content

This factor makes it an excellent choice, allowing you to earn above-average rewards for spending outside of the Sapphire Preferred’s bonus categories. Catch up on CNBC Select's in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date. One of the best and easiest options is to complete a balance transfer when you apply for a card. When you do this, you'll be able to make the most out of your intro APR because any 0% interest timeframe you qualify for begins when you open the card.

Browse credit cards by category

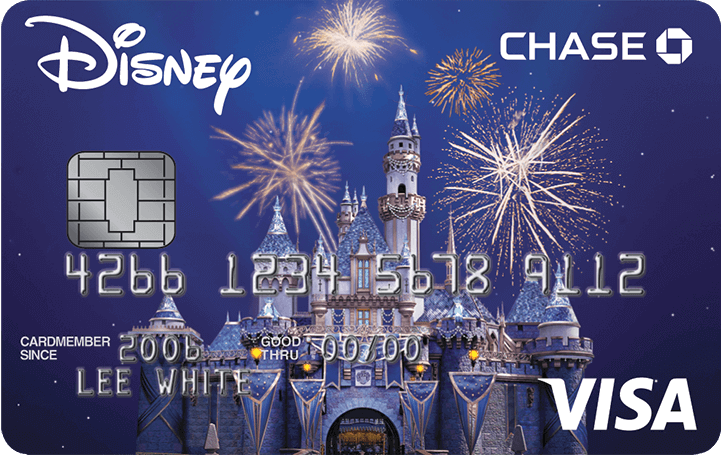

Accuracy, independence and authority remain as key principles of our editorial guidelines. For further information about automated content on CreditCards.com, email Lance Davis, VP of Content, at A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience. The post VISA and Chase Have Debuted a New Card Design for Disney World’s 50th Anniversary! This is the new design for the Chase Sapphire Preferred next to the Chase Sapphire Reserve and the old Chase Sapphire Preferred design (originally shared on FlyerTalk).

What is one disadvantage of a 0% interest balance transfer card?

Milnes holds a master’s degree in data science from Northwestern University. He geeks out on helping people feel on top of their credit card use, from managing debt to optimizing rewards. Earn 1% in Disney Rewards Dollars on all your card purchases with no limits to the amount you can earn. If your account is in good standing and the credit card is about to expire, we’ll automatically send you a new card during the month your current card will expire. If you haven’t received a new one, please call us at the number listed on your statement.

Chase Reveals New Benefits Coming to Sapphire Preferred and Reserve Credit Cards - Chase Media Center

Chase Reveals New Benefits Coming to Sapphire Preferred and Reserve Credit Cards.

Posted: Tue, 10 Aug 2021 07:00:00 GMT [source]

$150$250 not $150 $250 Statement Credit

Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions. If you have an American Express card – such as The Platinum Card® from American Express – you may be able to choose a custom design. Just this year, Amex released two new card designs for Platinum Card cardholders.

Earn up to 500 Disney Rewards Dollars per year

So, whether you’re a student, traveler or business person, there’s a card for you. Just make sure that you meet Chase’s eligibility requirements for the new card. To confirm if you’re able to upgrade or downgrade your card to your desired choice, simply contact Chase to get started. Discover is a top credit card issuer that offers extensive customization options. There are more than 150 different card designs to choose from, depending on which card you own.

The Chase Freedom Unlimited® is one of CNBC Select's top no-annual-fee cash-back credit cards with a unique intro bonus and a handful of useful benefits to complement its cash-back earnings. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate.

How do I request a replacement credit card if my card is damaged or no longer works?

A black credit card is an exclusive, invitation-only credit card issued by American Express. The so-called Amex black card is more formally known as the Centurion® Card from American Express, and it has become a status symbol in pop culture. It only comes with one design – a blue swirled pattern on the front of the card with the number printed – not embossed – on the back of the card. It’s also available only in plastic, not metal like the Sapphire Preferred and Sapphire Reserve cards.

Explore Disney® Visa® Credit Card designs

The Chase Freedom Flex℠ packs a punch with generous rewards in bonus categories that change every quarter and an easy-to-earn welcome bonus. This card's insurance benefits include purchase protection, extended warranty protection, roadside dispatch and rental car collision and theft coverage (secondary in the U.S.). When you upgrade, you’ll likely keep your same account information and credit limit. If you want to request an increase to your credit limit, different steps are required. It’s also important to note that you won’t be eligible for any sign-up bonuses, although you may be able to negotiate a targeted offer when you request your upgrade.

By strategically choosing which card to use for each purchase, you can earn the highest rewards rate possible. For example, you might use a card that offers bonus points on groceries for your grocery shopping and another card that rewards dining expenses when eating out. The Chase Sapphire Preferred® Card is considered one of the best travel credit cards, ideal for newbies and seasoned travel experts alike. It is renowned for its valuable rewards and generous points on travel and dining purchases. While the card has many notable benefits, it may not be sufficient on its own for consumers who want to maximize their rewards on every purchase.

If the Freedom Unlimited doesn’t quite align with your spending habits, you have plenty of other cards you can pair with the Sapphire Preferred. We’ve picked a few alternatives that balance out the Sapphire Preferred card’s category bonuses and benefits. If one card’s transfer partners have limited award inventory, the other card might come through. Or, if you want to stock up on points quickly for a specific award, applying for a second card with the same transfer partner options can help you save up the points faster.

It takes 7-10 business days to get a credit card from Chase once your application has been approved. But you can get it in 1-2 business days if you ask for expedited delivery, at no extra cost. It’s also worth noting that you may receive a decision instantly after approval, however it can sometimes take up to 30 days to receive a response. Make purchases with your debit card, and bank from almost anywhere by phone, tablet or computer and more than 15,000 ATMs and more than 4,700 branches. The card should arrive within five to seven business days in an unmarked envelope. If you want to expedite your debit card and receive it within two business days you can do that but you’ll have to pay $5 for the expedited delivery fee.

For example, you can’t change from a personal card category to a business card category. This is also true for Chase’s co-branded credit cards, such as the Marriott Bonvoy Boundless® Credit Card. So, you could switch this card with another Chase Marriott card, but not with a different co-branded card. From Feb. 1, 2023, through March 31, 2025, holders of the Chase Sapphire Preferred® Card can earn 5 points per dollar spent on eligible Peloton purchases, up to a maximum of 25,000 points. Purchases must be made directly through Peloton and paid in full at the time of purchase.

No comments:

Post a Comment